Emerging Revenue Models in the Age of AI and Disciplined Entrepreneurship

By Paul Cheek, Senior Advisor, Entrepreneurship & AI, Martin Trust Center for MIT Entrepreneurship

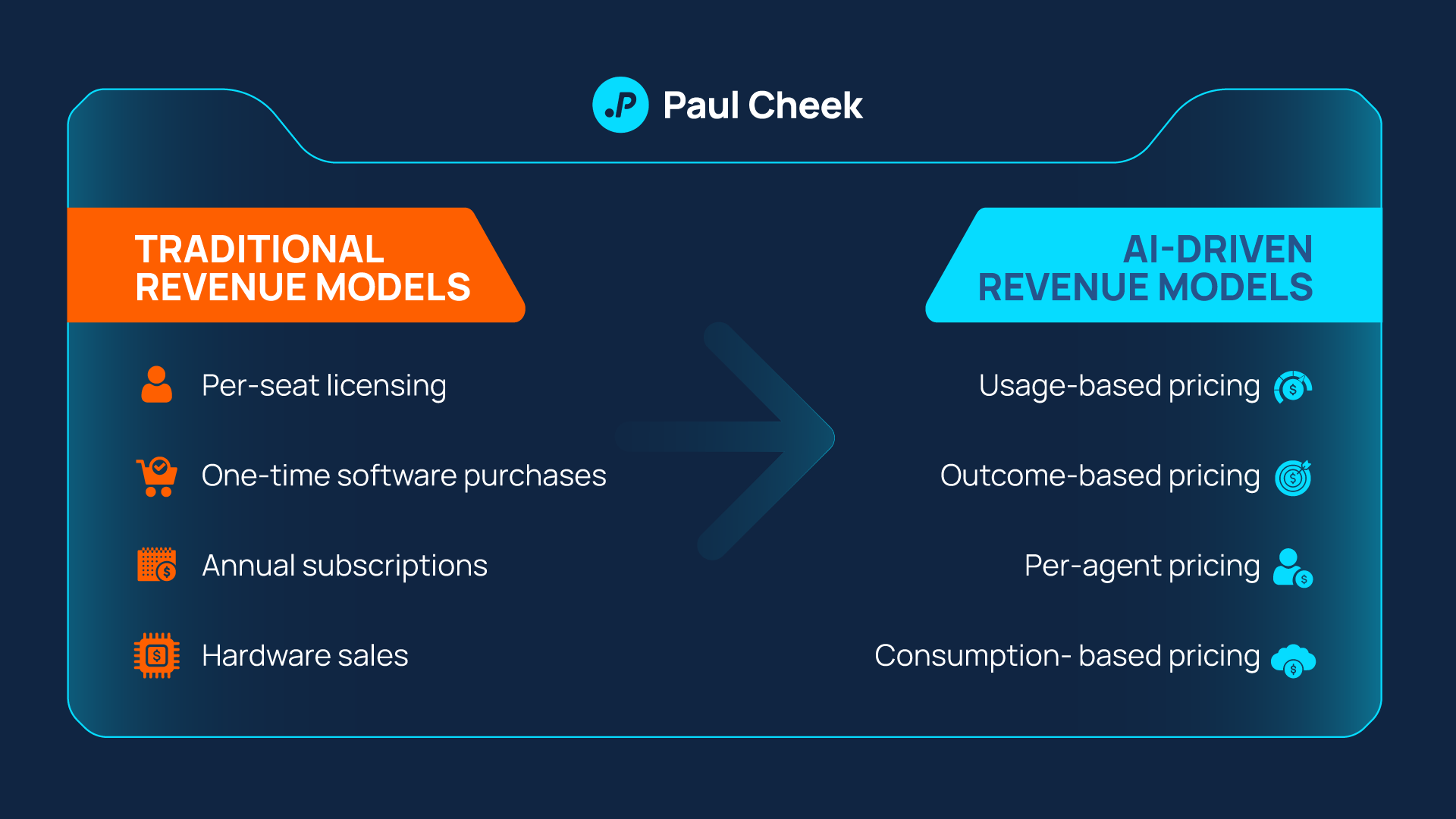

The business world is changing fast. We're seeing a shift as big as when companies moved from buying software once to paying monthly subscriptions. Just as Software-as-a-Service (SaaS) changed how businesses thought about software pricing, artificial intelligence is now driving an equally dramatic change in how companies make money [1]. This shift isn't just a small adjustment. It's a complete rethinking of how value gets created, delivered, and captured in the digital economy.

For years, businesses have relied on predictable ways to make money. Software companies charge monthly subscriptions. Others license their ideas for fees. Service companies charge per use. These models worked well during the SaaS era. They gave clear value and predictable income that entrepreneurs could plan around using proven methods like MIT's Disciplined Entrepreneurship approach [2]. But AI agents and automated systems are challenging these basic assumptions about how businesses should price their services.

The change is especially dramatic because AI changes the basic math of software delivery. Traditional software costs almost nothing extra to serve one more user. But AI-powered solutions cost money with every API call, every piece of text processed, and every model calculation [3]. While I enrcourage founders to avoid cost-based pricing whenever possible, focusing instead on value created for customers, the increase of unit costs with AI-enabled software delivery cannot be ignored. Put simply, R&D expenses are decreasing while costs of goods sold (COGS) are increasing for software. This shift from nearly zero extra costs to real variable expenses forces entrepreneurs to rethink not just their pricing, but their entire approach to creating and capturing value.

Look at what's happening in customer support software. Zendesk, a leader in this space, charges $115 per month for each support agent [4]. This made perfect sense when human agents drove customer support results. But when AI can handle many support tickets on its own, companies suddenly need fewer human agents, and therefore fewer software licenses. This forces software companies to completely rethink their pricing to match the results they deliver rather than the number of people using their software.

The effects go beyond individual companies to entire market categories. The Business Process Outsourcing (BPO) market is worth $152.8 billion in 2025, or about $877 per employee. This represents a huge opportunity for AI-driven solutions that can deliver similar results at lower costs with better service agreements [5]. This meeting of AI capabilities with traditional service markets is creating entirely new categories of revenue models that blend software efficiency with service-level results.

For entrepreneurs using the disciplined entrepreneurship framework, this change presents both huge opportunities and complex challenges. The systematic, 24-step approach developed at MIT provides a strong foundation for handling these changes, but it needs adaptation to account for the unique characteristics of AI-driven business models [6]. The key is understanding that while the basic principles of customer discovery, market validation, and systematic business building stay the same, the specific tactics for pricing and making money must change to match the new realities of AI-enabled value creation.

This change isn't happening alone. Venture capital firms like Andreessen Horowitz are actively documenting the shift toward outcome-based pricing models. They note that AI-native companies are leading the charge with usage-based, outcome-based, and hybrid pricing approaches [7]. Meanwhile, established companies are taking more conservative approaches, often bundling AI capabilities into existing seat-based models rather than completely reimagining their revenue structures.

The main argument of this analysis is that successful entrepreneurs in the AI era must master a new framework for revenue model selection. By applying disciplined entrepreneurship principles to these emerging AI-driven revenue models, founders can build sustainable, scalable businesses that capture maximum value while delivering unprecedented customer results.

Figure 1: The evolution from traditional software revenue models to AI-driven approaches represents a fundamental shift in how value is created and captured.

Framework for Choosing Revenue Models: The Four Pillars

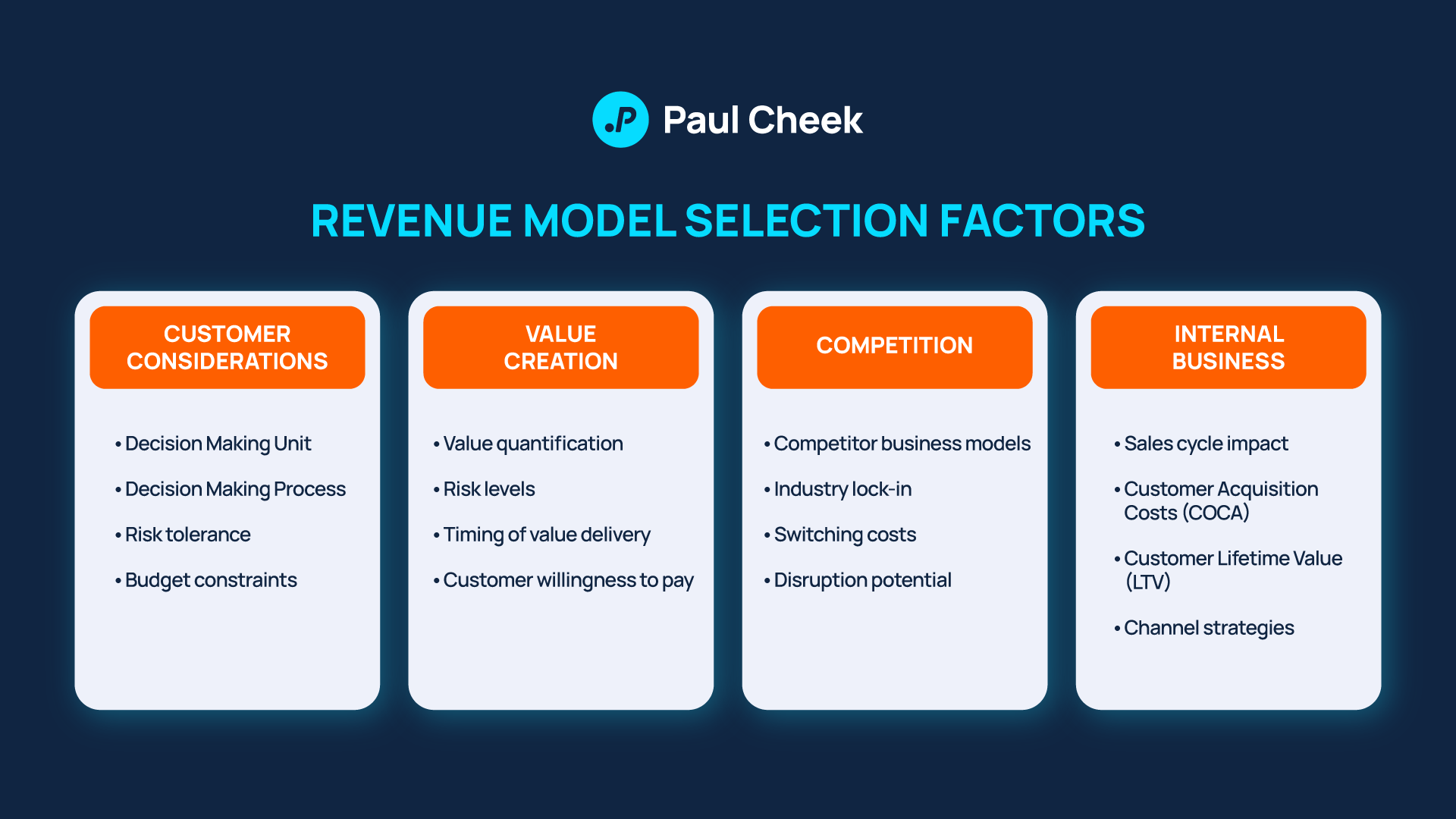

Selecting the best revenue model in the AI era requires a systematic evaluation framework that goes beyond gut feeling or copying what others do. Drawing from the disciplined entrepreneurship methodology pioneered at MIT, successful revenue model selection must consider four basic pillars: customer considerations, value creation dynamics, competitive environment, and internal business factors [8]. This framework gives entrepreneurs a structured approach to navigate the complex decision-making process that determines how their AI-powered solutions will generate sustainable revenue.

Customer Considerations: Understanding the Decision-Making Architecture

The first pillar focuses on deeply understanding how customers make purchasing decisions and what drives their willingness to pay for AI-powered solutions. This analysis begins with mapping the Decision Making Unit (DMU)—the collection of individuals and roles involved in the purchasing process. In AI implementations, the DMU often includes technical stakeholders who understand the capabilities and limitations of AI systems, financial decision-makers who evaluate return on investment, and operational leaders who will be responsible for integrating AI into existing workflows [9].

The Decision Making Process (DMP) for AI solutions frequently differs from traditional software purchases due to the transformative nature of AI implementations. Organizations often approach AI investments with a combination of excitement about potential results and anxiety about implementation difficulty. This dynamic creates unique considerations around risk tolerance, with many customers preferring to start with pilot programs or proof-of-concept implementations before committing to full-scale deployments.

Budget allocation patterns also shift dramatically in AI implementations. While traditional software purchases typically come from IT or departmental budgets, AI solutions often compete for funding from multiple budget categories. Per-agent pricing models can tap into headcount budgets, which are typically 10 times larger than technology tool budgets [10]. Usage-based models might draw from operational expense budgets, while outcome-based models could be funded from performance improvement or cost reduction initiatives.

Customer risk tolerance varies dramatically across industries and company sizes. Enterprise customers often prefer predictable pricing models that allow for accurate budgeting and financial planning, even if they pay a premium for that predictability. Conversely, startups and growth-stage companies may embrace usage-based models that align costs with business growth, accepting variability in exchange for lower initial commitments.

Value Creation: Quantifying and Timing AI-Driven Results

The second pillar examines how AI solutions create value for customers and when that value is realized. Unlike traditional software that often provides productivity improvements or workflow optimization, AI solutions frequently deliver transformational results that can be difficult to quantify and attribute. This difficulty requires entrepreneurs to develop sophisticated frameworks for measuring and communicating value creation.

Value quantification in AI implementations often involves multiple dimensions. Direct cost savings from automation can be relatively straightforward to calculate—replacing a $60,000 annual salary with a $2,000 monthly AI agent provides clear financial benefits [11]. However, AI solutions also generate indirect value through improved accuracy, 24/7 availability, scalability, and consistency that can be challenging to quantify but represent major customer benefits. One specific example of this shines through in a startup that I advise. They provide direct cost savings from human resourcing, but also revenue gains from the avoidance of lost appointment revenue with 24/7 agent-led appointment-booking capabilities. This compounds, but is incredibly difficult to accurately quantify.

The timing of value delivery plays a key role in revenue model selection. Some AI solutions provide immediate value through automation of routine tasks, making them suitable for usage-based or per-action pricing models. Others require longer implementation periods and learning curves before delivering major results, making them better candidates for outcome-based or subscription models that account for the investment period required to achieve results.

Risk levels from the customer's viewpoint must also be carefully evaluated. AI implementations often involve changing established workflows, training staff on new systems, and potentially reducing human headcount. These changes create organizational risk that must be balanced against the potential benefits. Revenue models that share risk between vendor and customer—such as outcome-based pricing with performance guarantees—can help address customer concerns while aligning incentives for successful implementation.

Competition: Navigating the Evolving AI Environment

The competitive environment for AI solutions is rapidly evolving, with new entrants, changing business models, and shifting customer expectations creating a dynamic environment that requires constant monitoring and adaptation. Understanding competitive dynamics is essential for revenue model selection because pricing strategies that work in blue ocean markets may fail when facing direct competition.

Industry lock-in and switching costs vary dramatically across different AI applications. Solutions that integrate deeply with existing systems or require major training and customization create higher switching costs, allowing for premium pricing models. Conversely, AI solutions that can be easily replaced or that operate in commoditized markets face pressure toward usage-based or competitive pricing models.

The potential to disrupt existing business models represents both an opportunity and a risk. AI solutions that can deliver similar results to traditional service providers at dramatically lower costs have the opportunity to capture market share rapidly. However, this disruption potential also attracts competition and can lead to price compression as the market matures.

Competitive differentiation becomes increasingly important as AI markets mature. Early entrants may succeed with basic per-action pricing models, but sustained competitive advantage often requires more sophisticated approaches that are harder for competitors to replicate. Complex workflow-based pricing or outcome-based models with proprietary measurement capabilities can provide competitive protection that simple usage-based models cannot match.

The competition is a critical factor especially while enterprises are evauating a variety of tools and pricing plays a key role in determining which tools to pilot… and which to stick with once proven successful.

Internal Business Considerations: Aligning Revenue Models with Operational Realities

The fourth pillar examines how different revenue models impact the internal operations and financial dynamics of the AI company itself. This analysis is important because revenue models that appear attractive from a customer viewpoint may create operational challenges or financial risks that undermine business sustainability.

Sales cycle length and Customer Acquisition Cost (CAC/COCA) vary dramatically across different revenue models. Per-agent pricing models often have shorter sales cycles because they align with familiar headcount budgeting processes and provide clear value propositions. Usage-based models may require longer education periods to help customers understand cost implications and usage patterns. Outcome-based models typically involve the longest sales cycles due to the need for detailed performance measurement discussions and contract negotiations.

Customer Lifetime Value (LTV) calculations become more complex in AI implementations due to the variable cost structure of AI services. Traditional SaaS companies could assume near-zero marginal costs for additional usage, but AI companies must account for compute costs, model inference fees, and other variable expenses that scale with customer usage. This difficulty requires more sophisticated financial modeling and pricing strategies that maintain healthy unit economics across different usage patterns.

Channel and distribution strategies must also align with revenue model choices. Direct sales models work well for complex outcome-based pricing that requires major customization and relationship building. Self-service models are better suited to simple usage-based pricing that customers can understand and implement independently. Partner channels may prefer predictable commission structures that align with subscription or per-agent models rather than variable outcome-based compensation.

Figure 2: The four-pillar framework for revenue model selection from Disciplined Entrepreneurship provides a systematic approach to evaluating customer, value, competitive, and internal factors.

The integration of these four pillars creates a thorough decision-making framework that enables entrepreneurs to select revenue models that align with customer needs, competitive dynamics, and internal capabilities. This systematic approach, rooted in disciplined entrepreneurship principles, provides the foundation for building sustainable AI businesses that can adapt to the rapidly evolving market while maintaining strong unit economics and customer satisfaction.

Emerging AI-Driven Revenue Models: Real Examples and Analysis

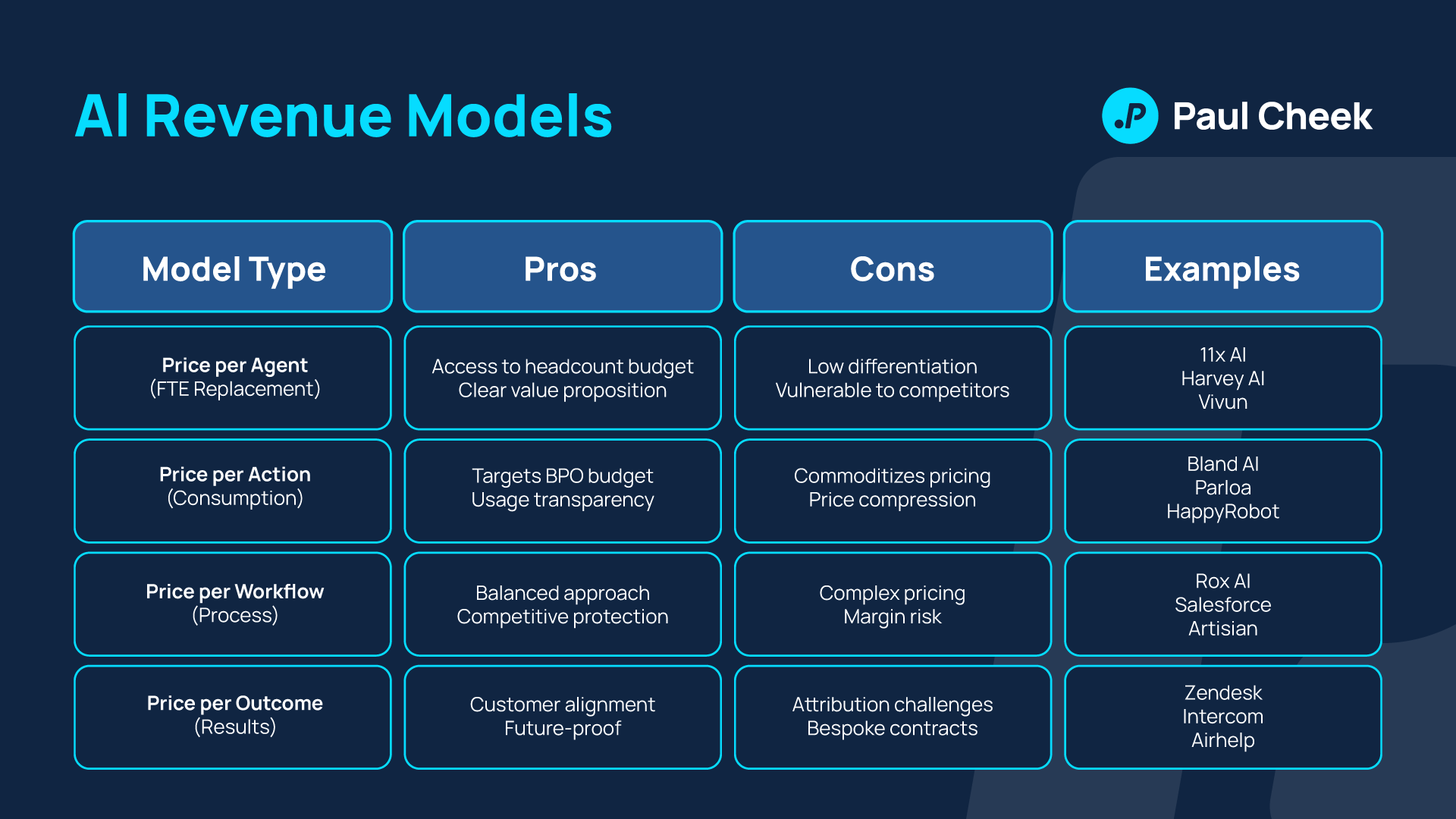

The analysis of over 60 AI agent companies from Growth Unhinged reveals four dominant pricing models that have emerged as viable approaches to making money from AI-powered solutions [12]. Each model represents a different philosophy about value creation and capture, with distinct advantages, challenges, and optimal use cases. Understanding these models and their real-world implementations provides entrepreneurs with practical frameworks for designing their own revenue strategies.

Price per Agent: The FTE Replacement Model

The price per agent model positions AI solutions as direct replacements for human employees, charging a fixed monthly fee for each AI agent deployed. This approach uses the familiar concept of headcount budgeting, making it easier for customers to understand and justify the investment. Companies like 11x AI, Harvey AI, and Vivun have successfully implemented variations of this model, each targeting different market segments and use cases.

11x AI shows this approach in the sales development space, charging approximately $5,000 per month for their AI SDR agent "Alice" that handles 3,000 email contacts [13]. The value proposition is straightforward: replace a $60,000 annual human SDR salary with a $60,000 annual AI agent that works 24/7, never takes vacation, and maintains consistent performance. This clear cost comparison makes the business case compelling for sales organizations looking to scale their outbound efforts.

Harvey AI has taken this model into the legal industry, charging an estimated $1,000-$1,200 per attorney per month for AI assistance with legal research, document drafting, and analysis [14]. The legal market's high labor costs and billable hour structure make the per-agent model particularly attractive, as law firms can easily calculate the return on investment based on improved attorney productivity and reduced research time.

One further example that I use personally is Howie AI. Howie provides email scheduling services coordinating meetings between any number of participants. Replacing a human scheduling assistant at a cost of $60,000/annually or outsources virtual assistant at a cost of $2,500/month, Howie provides a very clear value proposition at just $29/month.

The advantages of the per-agent model are major. It provides access to headcount budgets, which are typically 10 times larger than technology tool budgets, creating a larger addressable market for AI solutions [15]. The value proposition is clear and easy to communicate, reducing sales cycle difficulty and customer education requirements. Additionally, the predictable recurring revenue structure aligns well with traditional SaaS financial models and investor expectations.

However, the model also faces important limitations. Low competitive differentiation makes companies vulnerable to "cheaper competitor" threats, as the pricing structure is easily replicated and compared. As AI capabilities become commoditized, maintaining premium pricing becomes increasingly difficult. The model also faces pressure from declining AI costs, as customers may expect price reductions as the underlying technology becomes less expensive.

Future-proofing strategies for the per-agent model focus on shifting the value proposition from "cheaper than human" to "vastly more capable than human." This involves bundling additional capabilities and integrations into the fixed price, creating tiered agent levels with clear capability differentiators, and developing proprietary features that resist commoditization.

Price per Action: The Consumption-Based Approach

The price per action model charges customers based on discrete activities performed by AI agents, such as phone calls made, emails sent, or documents processed. This consumption-based approach provides transparency and aligns costs directly with usage, making it attractive for organizations with variable workloads or those testing AI implementations.

Bland AI has built their business around this model, charging $0.09 per minute for AI-powered phone calls [16]. This pricing structure allows customers to start small and scale usage based on results, reducing the barrier to entry while ensuring that costs align with value received. The model works particularly well for call center applications where the volume of interactions varies dramatically based on business cycles and customer demand.

Reducto offers AI-powered document processing, specifically converting complex PDF documents to data that LLMs can understand. Their pricing model follows a credit-based consumption approach that mirrors the “cell phone plan” revenue model that we teach at MIT whereby customers pay a monthly fee which includes a certain number of credits. Credits consumed above the plan’s limit are charged at a consumption-based price point.

Parloa AI targets enterprise contact centers with a consumption-based model that starts at approximately $300,000 annually for large-scale implementations [17]. While the entry point is higher than other consumption models, the pricing still scales with usage, allowing enterprise customers to predict costs based on call volume and interaction difficulty.

HappyRobot AI focuses on the logistics industry with a $0.25 per minute pricing model for AI workers that handle communication across the supply chain [18]. The higher per-minute rate reflects the specialized nature of logistics communication and the complex workflows involved in freight brokerage and 3PL operations.

The consumption-based model offers several advantages. It can effectively target the BPO budget, which represents $152.8 billion annually or $877 per employee, providing a large addressable market for AI solutions that can deliver better results at competitive prices [19]. The transparency of usage-based pricing builds customer trust and allows for easy cost prediction based on business volume.

The primary disadvantage of consumption-based pricing is its tendency toward commoditization. When pricing is directly tied to discrete actions, it becomes easy for customers to compare providers based solely on per-action costs, leading to price compression and margin erosion. The model also has a direct correlation to dropping technology costs, making it vulnerable to competitive pressure as AI inference costs continue to decline.

Companies using consumption-based models should consider transitioning to workflow or outcome-based approaches as they mature. Adding proprietary capabilities that are not available in commodity offerings and focusing on specialized domains where expertise commands premium pricing can help maintain differentiation and pricing power.

Price per Workflow: The Process Automation Model

The price per workflow model charges based on completed multi-step processes rather than individual actions, representing a middle ground between consumption-based and outcome-based pricing. This approach recognizes that customers often care more about complete process automation than individual task execution, allowing for more sophisticated value capture.

Rox AI has implemented this model for sales processes, starting at $750 per month with team-based scaling for AI agents that handle account planning, research, and engagement workflows [20]. Rather than charging per email sent or per research task completed, Rox prices based on complete account management workflows that deliver thorough sales support.

Artisan AI takes a similar approach with their AI BDR "Ava," offering customized pricing for complete outbound sales workflows that include lead discovery, data enrichment, personalized outreach, and deliverability management [21]. The workflow-based pricing allows Artisan to capture value for the complete solution rather than competing on individual component costs.

Salesforce has integrated workflow-based AI pricing into their existing platform, charging for AI capabilities at higher tiers of their traditional seat-based model. This hybrid approach allows them to capture additional value for AI-enhanced workflows while maintaining their established pricing structure for core CRM functionality.

The workflow-based model provides a balanced approach that is easier to implement than outcome-based pricing while offering more competitive protection than simple consumption models. Complex workflows are harder for competitors to replicate and price, providing some differentiation advantages. The model also aligns well with customer thinking about process improvement and automation.

However, workflow-based pricing faces challenges in standardization and margin management. Standard workflows like email composition or account research remain vulnerable to price compression, while complex workflows can be difficult to price accurately, potentially leading to negative margins for longer-running processes. The difficulty of defining and measuring workflows can also create customer confusion and sales cycle delays.

Success with workflow-based pricing requires focusing on complex, multi-step workflows with clear ROI that can be demonstrated to customers. Developing proprietary workflow components that resist commoditization and bundling analytics and optimization capabilities into the workflow pricing can help maintain competitive advantages.

Price per Outcome: The Results-Based Future

The price per outcome model represents the most sophisticated approach to AI pricing, charging customers based on achieved results rather than activities performed. This model creates the strongest alignment between vendor and customer interests while providing the greatest protection against commoditization and price compression.

Zendesk is evolving toward outcome-based pricing for their AI-enhanced customer support platform, moving from traditional per-seat pricing to models based on successful ticket resolution and customer satisfaction results [22]. This shift recognizes that customers ultimately care about support quality and resolution rates rather than the number of agents or interactions required.

Intercom has implemented outcome-based pricing for customer engagement, charging based on successful customer interactions and conversion results rather than message volume or feature usage [23]. This approach aligns pricing with the business value that customers receive from improved customer engagement and conversion rates.

Airhelp demonstrates outcome-based pricing in the travel industry, charging customers only when they successfully obtain compensation for flight delays and cancellations [24]. This model eliminates customer risk while ensuring that Airhelp is incentivized to maximize successful results rather than simply processing claims.

The advantages of outcome-based pricing are compelling. It provides the highest level of customer alignment by ensuring that vendors are paid only when customers receive value. This model offers the strongest protection against competitive displacement and price compression because it focuses on results rather than activities. From an investor viewpoint, outcome-based pricing is increasingly favored as it demonstrates clear value creation and sustainable competitive advantages.

However, outcome-based pricing also presents major challenges. Attribution can be complex, particularly in environments where multiple factors contribute to results. The model often requires bespoke contracts and customized measurement frameworks, increasing sales difficulty and operational overhead. Success with outcome-based pricing requires high confidence in the AI system's ability to consistently deliver measurable results.

Companies implementing outcome-based pricing should develop robust attribution methodologies that can clearly demonstrate the AI system's contribution to results. Creating shared risk/reward models with performance guarantees and bonuses for exceptional results can help align incentives while managing vendor risk. Focusing on high-value business results that can be measured objectively provides the foundation for sustainable outcome-based relationships.

Figure 3: Comparison of the four primary AI revenue models showing their respective advantages, disadvantages, and real-world examples.

The evolution of these revenue models reflects the broader maturation of the AI industry and the increasing sophistication of both vendors and customers in understanding AI value creation. While each model has its place in the current market, the trend toward outcome-based pricing suggests that the most successful AI companies will be those that can demonstrate clear, measurable value creation for their customers while building sustainable competitive advantages that resist commoditization.

Systematic Experimentation and Iteration

The disciplined entrepreneurship framework emphasizes systematic experimentation over gut-feeling-based decision making, a principle that becomes particularly important in AI revenue model selection. Unlike traditional software where pricing models have been established and tested over decades, AI revenue models are still emerging, requiring entrepreneurs to approach pricing as a series of hypotheses to be tested rather than assumptions to be implemented.

The experimentation process begins with clearly defining pricing hypotheses based on the four-pillar framework. For example, an AI company might hypothesize that their target customers prefer outcome-based pricing because they are risk-averse and want to ensure ROI before paying. This hypothesis can then be tested through customer interviews, pilot programs, and A/B testing of different pricing presentations during the sales process.

Systematic iteration requires establishing clear metrics and measurement frameworks before implementing pricing experiments. Key metrics might include conversion rates at different price points, customer lifetime value across different pricing models, time to value realization, and customer satisfaction scores. By establishing these metrics upfront, entrepreneurs can make data-driven decisions about pricing model effectiveness rather than relying on anecdotal feedback or revenue growth alone.

The iterative approach also recognizes that optimal pricing models may change as the market matures and customer understanding of AI value increases. Early adopters may be willing to pay premium prices for cutting-edge AI capabilities, while mainstream customers may require more predictable, lower-risk pricing models. Systematic iteration allows companies to adapt their pricing strategies as they move through different customer segments and market maturity stages.

Risk Management Strategies for New Models

The disciplined entrepreneurship framework also emphasizes systematic risk management, a principle that becomes important when implementing innovative AI revenue models. Each pricing model carries different risk profiles that must be carefully managed to ensure business sustainability while maximizing customer value.

Pilot programs represent one of the most effective risk management strategies for new pricing models. Rather than immediately implementing outcome-based pricing across all customers, companies can start with pilot programs that test the model with a small number of customers who are willing to experiment. These pilots provide valuable data about implementation challenges, measurement difficulties, and customer satisfaction while limiting the company's exposure to potential problems.

Phased rollouts allow companies to gradually transition from established pricing models to more innovative approaches. For example, a company might start with per-agent pricing to establish market presence and customer relationships, then introduce workflow-based pricing for specific use cases, and finally evolve to outcome-based pricing as they develop robust measurement capabilities and customer trust.

Clear measurement and attribution frameworks become essential for managing the risks associated with outcome-based pricing. Companies must invest in sophisticated analytics and measurement systems that can accurately attribute results to AI interventions, distinguish between correlation and causation, and provide transparent reporting to customers. Without these capabilities, outcome-based pricing becomes too risky for both vendor and customer.

Contractual risk management also requires careful attention in AI revenue models. Outcome-based contracts should include clear definitions of success metrics, measurement methodologies, and dispute resolution processes. Performance guarantees and service level agreements help manage customer expectations while protecting the vendor from unrealistic outcome expectations or external factors beyond their control.

Using AI Tools for Pricing Optimization

The disciplined entrepreneurship approach encourages entrepreneurs to use all available tools and technologies to optimize their business operations, including the use of AI tools to analyze customer data and forecast revenue impact of different pricing models. This meta-application of AI to AI business model optimization represents a sophisticated approach to pricing strategy development.

Customer data analysis using AI tools can reveal patterns in usage, value realization, and pricing sensitivity that inform more effective pricing strategies. Machine learning algorithms can identify customer segments with different pricing preferences, predict which customers are most likely to succeed with outcome-based pricing, and optimize pricing parameters for different market segments.

Revenue forecasting becomes more sophisticated when AI tools are used to model the impact of different pricing strategies on customer acquisition, retention, and expansion. These models can account for the complex interactions between pricing models, customer success, and competitive dynamics to provide more accurate predictions of business performance under different pricing scenarios.

Predictive analytics can also help identify optimal timing for pricing model transitions. By analyzing customer usage patterns, success metrics, and engagement levels, AI tools can identify when customers are ready to transition from pilot programs to full implementations, or from simpler pricing models to more sophisticated outcome-based approaches.

Dynamic pricing optimization represents an advanced application of AI to pricing strategy, where algorithms continuously adjust pricing parameters based on real-time market conditions, customer behavior, and competitive dynamics. One such example of this is the solution provided by Catalan.ai, an MIT delta v alumni company. Spun out of the MIT Media Lab and Martin Trust Center for MIT Entrepreneurship, Catalan provides AI-powered dynamic pricing software to enterprises. While this level of sophistication may not be appropriate for all AI companies, it demonstrates the potential for using AI tools to optimize AI business models.

The integration of AI tools into pricing strategy development also provides competitive advantages by enabling more sophisticated analysis and faster response to market changes than competitors using traditional pricing approaches. Companies that effectively use AI for pricing optimization can achieve better unit economics, higher customer satisfaction, and stronger competitive positioning in rapidly evolving markets.

This systematic, founder-led, and technology-enhanced approach to pricing strategy development shows the disciplined entrepreneurship mindset applied to the unique challenges of AI revenue models. By combining proven entrepreneurship principles with innovative pricing approaches and sophisticated analytical tools, entrepreneurs can build sustainable AI businesses that deliver exceptional value to customers while achieving strong financial performance.

The transformation of revenue models in the age of AI represents more than a tactical shift in pricing strategies—it signals a basic evolution in how value is created, delivered, and captured in the digital economy. The systematic analysis of customer considerations, value creation dynamics, competitive environment, and internal business factors provides entrepreneurs with a robust framework for navigating this transformation while building sustainable, scalable businesses.

The evidence from over 60 AI agent companies demonstrates that successful revenue model selection requires moving beyond simple cost-plus pricing or competitive mimicry toward sophisticated frameworks that align pricing with customer value realization and business model sustainability [27]. The four primary models—per-agent, per-action, per-workflow, and per-outcome—each serve different market needs and business contexts, but the clear trend toward outcome-based pricing suggests that the most successful AI companies will be those that can demonstrate measurable value creation for their customers.

Looking toward the future, several trends will likely shape the continued evolution of AI revenue models. The dramatic reduction in LLM costs—expected to drop 10-100x over the next 3-5 years—will create pressure on usage-based pricing models while potentially enabling more sophisticated outcome-based approaches that can absorb variable cost fluctuations [29]. The maturation of AI measurement and attribution technologies will make outcome-based pricing more feasible for a broader range of applications, while the increasing sophistication of AI customers will drive demand for more nuanced and flexible pricing approaches.

The convergence of AI capabilities with traditional service industries will continue to create new hybrid models that blend software efficiency with service-level results. As Jackie DiMonte notes, the key to understanding which software models will create the most value lies in the economics of traditional industries, suggesting that successful AI entrepreneurs will be those who can effectively bridge the gap between software innovation and established business practices [30].

The ecosystem supporting AI revenue model innovation is also rapidly evolving. New tools and frameworks for measuring AI results, managing variable costs, and optimizing pricing strategies are emerging from both established software companies and AI-native startups. This expanding toolkit will enable more entrepreneurs to experiment with sophisticated pricing models that were previously accessible only to companies with major technical and analytical resources.

For entrepreneurs entering the AI space, the imperative is clear: actively integrate AI's possibilities into business model innovation while maintaining the systematic, disciplined approach that has proven successful in traditional entrepreneurship. The companies that will thrive in the AI era will be those that can combine cutting-edge AI capabilities with proven business building methodologies, creating sustainable competitive advantages that resist commoditization while delivering exceptional customer value.

The transformation is still in its early stages, with major opportunities remaining for entrepreneurs who can effectively navigate the intersection of AI innovation and disciplined business building. The frameworks and examples presented in this analysis provide a foundation for that navigation, but the ultimate success will depend on systematic execution, continuous learning, and relentless focus on customer value creation.

The rapidly evolving world of AI revenue models presents both unprecedented opportunities and complex challenges for entrepreneurs. To capitalize on these opportunities while avoiding common pitfalls, consider these next steps:

Reflect on your current revenue model using the four-pillar framework from Disciplined Entrepreneurship presented in this analysis. Evaluate how well your pricing strategy aligns with customer considerations, value creation dynamics, competitive environment, and internal business factors. Identify gaps or misalignments that may be limiting your growth potential or creating vulnerability to competitive threats.

Experiment with new AI-driven pricing models where appropriate, using the systematic approach advocated by disciplined entrepreneurship. Start with pilot programs or limited implementations that allow you to test new pricing approaches without risking your entire business. Use direct market feedback to validate assumptions and iterate quickly based on customer responses.

Share information from this analysis with your team and entrepreneurship community to spark revenue innovation conversations. The collective learning that emerges from shared experiences and collaborative problem-solving will benefit the entire AI entrepreneurship ecosystem while helping individual companies avoid common mistakes and identify best practices.

Deepen your tactical expertise in business model development. The combination of theoretical frameworks and practical implementation experience will enhance your ability to navigate the complex decisions involved in AI revenue model selection.

The future belongs to entrepreneurs who can effectively combine AI innovation with disciplined business building. By taking action on these recommendations, you position yourself to be among the leaders who shape the next generation of AI-powered businesses while delivering exceptional value to customers and stakeholders.

References

[1] Andreessen Horowitz. (2024, December 19). AI Is Driving A Shift Towards Outcome-Based Pricing. https://a16z.com/newsletter/december-2024-enterprise-newsletter-ai-is-driving-a-shift-towards-outcome-based-pricing/

[2] MIT Disciplined Entrepreneurship. (2024). The Framework. https://www.d-eship.com/about/framework/

[3] Andreessen Horowitz. (2024, December 19). AI Is Driving A Shift Towards Outcome-Based Pricing. https://a16z.com/newsletter/december-2024-enterprise-newsletter-ai-is-driving-a-shift-towards-outcome-based-pricing/

[4] Andreessen Horowitz. (2024, December 19). AI Is Driving A Shift Towards Outcome-Based Pricing. https://a16z.com/newsletter/december-2024-enterprise-newsletter-ai-is-driving-a-shift-towards-outcome-based-pricing/

[5] Medina, M. (2025, April 9). A new framework for AI agent pricing. Growth Unhinged. https://www.growthunhinged.com/p/ai-agent-pricing-framework

[6] Cheek, P. (2024). About Paul. https://www.paulcheek.com/about-paul-cheek

[7] Andreessen Horowitz. (2024, December 19). AI Is Driving A Shift Towards Outcome-Based Pricing. https://a16z.com/newsletter/december-2024-enterprise-newsletter-ai-is-driving-a-shift-towards-outcome-based-pricing/

[8] MIT Disciplined Entrepreneurship. (2024). The Framework. https://www.d-eship.com/about/framework/

[9] Medina, M. (2025, April 9). A new framework for AI agent pricing. Growth Unhinged. https://www.growthunhinged.com/p/ai-agent-pricing-framework

[10] Medina, M. (2025, April 9). A new framework for AI agent pricing. Growth Unhinged. https://www.growthunhinged.com/p/ai-agent-pricing-framework

[11] Medina, M. (2025, April 9). A new framework for AI agent pricing. Growth Unhinged. https://www.growthunhinged.com/p/ai-agent-pricing-framework

[12] Medina, M. (2025, April 9). A new framework for AI agent pricing. Growth Unhinged. https://www.growthunhinged.com/p/ai-agent-pricing-framework

[13] SDRX.ai. (2024, December 24). 11x.ai Pricing: Is This The Best AI SDR For Your Sales Process? https://www.sdrx.ai/blog/11x-ai-pricing/

[14] Callidus Legal AI. (2024). Callidus Legal AI vs. Harvey AI. https://callidusai.com/callidus-ai-vs-harvey-ai/

[15] Medina, M. (2025, April 9). A new framework for AI agent pricing. Growth Unhinged. https://www.growthunhinged.com/p/ai-agent-pricing-framework

[16] Synthflow AI. (2025). Decoding Bland AI Pricing 2025 - A Comparative Insight. https://synthflow.ai/blog/bland-ai-pricing

[17] Synthflow AI. (2025, May 21). Honest Parloa Review 2025: Pros, Cons, Features & Pricing. https://synthflow.ai/blog/parloa-review

[18] HappyRobot. (2024). Pricing. https://docs.happyrobot.ai/general/pricing

[19] Medina, M. (2025, April 9). A new framework for AI agent pricing. Growth Unhinged. https://www.growthunhinged.com/p/ai-agent-pricing-framework

[20] LeadRPro. (2025, February 3). Rox vs Jeeva.ai: Choosing Your AI Sales Development Champion. https://www.leadrpro.com/blog/rox-vs-jeeva-ai-choosing-your-ai-sales-development-champion

[21] Artisan. (2024). Artisan Plans & Pricing. https://www.artisan.co/pricing

[22] Andreessen Horowitz. (2024, December 19). AI Is Driving A Shift Towards Outcome-Based Pricing. https://a16z.com/newsletter/december-2024-enterprise-newsletter-ai-is-driving-a-shift-towards-outcome-based-pricing/

[23] Medina, M. (2025, April 9). A new framework for AI agent pricing. Growth Unhinged. https://www.growthunhinged.com/p/ai-agent-pricing-framework

[24] Medina, M. (2025, April 9). A new framework for AI agent pricing. Growth Unhinged. https://www.growthunhinged.com/p/ai-agent-pricing-framework

[25] Cheek, P. (2024). About Paul. https://www.paulcheek.com/about-paul-cheek

[26] MIT News. (2024, May 3). 3 Questions: Paul Cheek on tactics for new startups. https://news.mit.edu/2024/3-questions-paul-cheek-startup-tactics-book-0503

[27] Medina, M. (2025, April 9). A new framework for AI agent pricing. Growth Unhinged. https://www.growthunhinged.com/p/ai-agent-pricing-framework

[28] Cheek, P. (2024). About Paul. https://www.paulcheek.com/about-paul-cheek

[29] Medina, M. (2025, April 9). A new framework for AI agent pricing. Growth Unhinged. https://www.growthunhinged.com/p/ai-agent-pricing-framework

[30] DiMonte, J. (2025, March 18). AI Raises a Big Question, but Legacy Industries Have Already Answered It. Day by Jay. https://jaydimonte.substack.com/p/ai-raises-a-big-question-but-legacy